What do We do

Media house for latest happenings and trends in Insurance industry.

Aspiring search engine for Insurance .

Create a talent pool of Insurance professionals for the Industry.

Simplify Insurance concepts to educate insurance buyers.

To create awareness & importance of insurance in the society.

Identify Insurance needs of society at large and educate on appropriate products for each of these needs.

Educating people below poverty line about the Govt insurance schemes and offerings.

Educating insurance buyers about grievance redressal mechanisms.

Who are we

Passionate team of Insurance & Technology professionals who are enthusiastic to integrate Insurance & Technology to find practical insurance and risk management solutions.

ATMARAM CHERUVU

Co-Founder & Director

Electrical Engineer, Law graduate and MBA in finance, Atma has over 32 years experience in Risk Management, Insurance and Reinsurance. He was Head (Property & Casualty) and Chief Underwriting Officer of Hannover Re branch in India. He was Member of the Branch steering Board. Earlier to Hannover Re, He held senior positions in Sompo Japan and Royal Sundaram.

He has been trained extensively on Risk Management, Insurance & Reinsurance in Europe, North America and Asia. He is a passionate training facilitator on various areas of Risk Management, Reinsurance and Insurance. He has conducted many programs internationally and is well recognised for simplifying the complex subjects. He has presented many papers at various National / International Seminars.

PSK VARMA

Founder & Director Mr.Varma, Director of Paisaplan, Founder & CEO of Techsophy(An AI company). He has formidable experience in managing R&D teams, running delivery organizations, providing strategic direction for companies, identifying market gaps and coming up with innovative solutions. In a career spanning over 20 years, he has been associated with several Global Fortune companies to formulate business solutions, devise product architectures, implement agile processes and setup, manage and scale Offshore Development centres. He is adept at building strategic partnerships with large enterprise software vendors and managing key accounts. He comes with a formidable technology background having built products and solutions for enterprises across Banking, Insurance, Financial Services, Healthcare and IT sectors. He believes in transparent management style and supports open communications. Varma is passionate about building start-ups and supporting them through their initial stages and helps investors and entrepreneurs with valuations, fund raising and execution. His interests are around economic empowerment and science & technology. He is also an active supporter of social causes – associated with LVPEI and NOBLE foundation for GIOE students.

RAM PATRUDU

Co-Founder & Director Mr.Patrudu, Co-Founder & Director of Paisaplan is a young and energetic Marketing professional. His experience with multiple start ups brings in his innovative attitude to build products which solve the market problems. His ideology towards bringing youngsters to comprehend the way they spend and streamline their spend behaviour's to protect them from every risk led him to build this platform. His vision is to build a company which helps people in their day-to-day life they come across with regards to finance and insurance. He has always been a risk taker and go-getter from his early days of career. His insight towards insure-tech & fintech platforms has marshalled him in building this. He handled large corporate clients in his career with utmost good care in resolving their issues related to Insurance and finance. His relations with Insurer’s and Clients always made him stand ahead in the industry.

Who can enroll?

- Insurance companies

- Insurance Broking Firms

- Reinsurance Companies

- Insurance buyers (Insurance and RM verticals)

- IT Professionals handling BFSI

- Students

Upcoming Training

Business Interruption –

FLOP, MLOP, ALOP, DSU.

Risk & Insurance solutions

for Pharma Industry

Risk & Insurance

solutions for IT Industry.

Risk & Insurance solutions for

Infrastructure projects.

Managing risks and cost

effective insurance solutions

exclusively for start up’s.

- Fire

- Coverage Under Fire

- Spontaneous Combustion – Add on Cover

- Coverage Under Explosion

- RSMD & Terrorism

- Nat Cat Perils

- Add on Covers – Debris Removal, Loss of Rent, rent for alternative accommodation, Start Up Expenses, Omission to Insure

- Escalation Clause

- Declaration & Floater Facility

- RIV vs MV Calculations

- Claim Calculations.

- IAR: Exclusions, Add on Covers, Clauses & Claim Calculations

- Understanding Risk Exposures and Various wordings used in the market for covering Terrorism & Sabotage both under material damage and business interruption.

- Understanding the insurance products for Political violence and how it can overlap with coverages under Industrial All Risk Policy.

- Understanding the working of Terrorism Pools and how these pools are protected by Reinsurance.

- Understanding Political Risk products for Equity Investors, Project Lenders, Exporters and Contractors.

- Understanding role of Reinsurance in these covers.

- Understanding nature of claims under these covers.

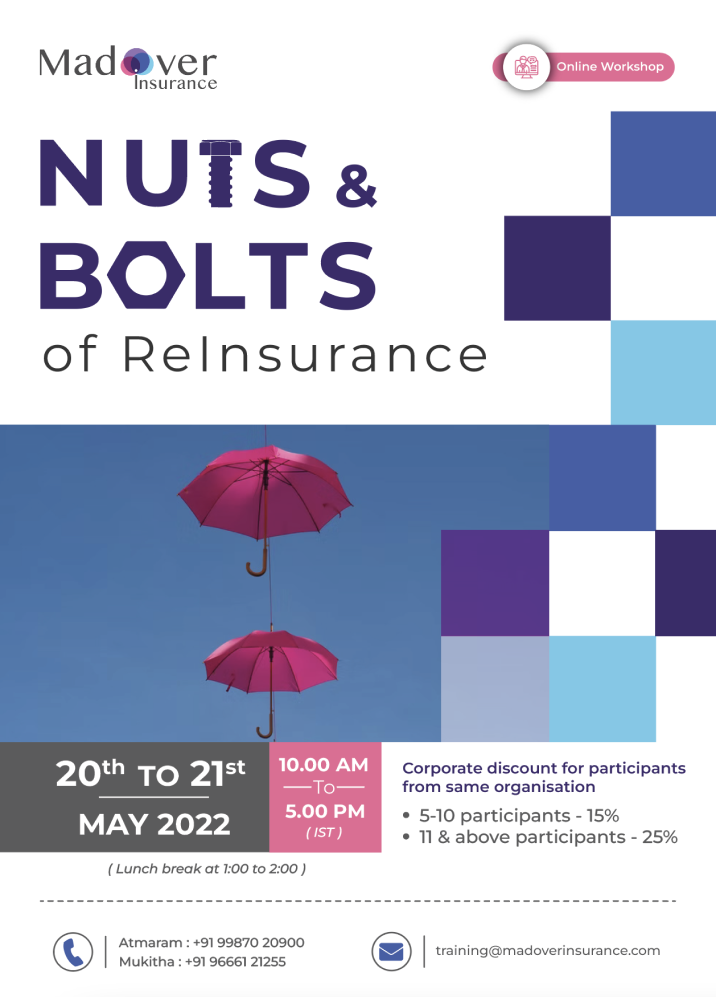

- Introduction to Reinsurance

- Retrocession

- Quota Share and Surplus Reinsurance

- Allocation of premium between cedant and reinsurers and calculation of facultative requirement

- Setting retention

- Graded Retentions

- Second Surplus and Third Surplus

- PML underwriting vs Sum Insured underwriting

- Quota Share for Financial Relief, Solvency Relief and Catastrophic accumulation management

- Fixed commission, Sliding scale commission and Profit Commission

- Event Limits

- Loss Participation clause

- Concept of Treaty Balance

- Combined Quota share and Surplus treaty

- Exclusions

- Important clauses

- Accounting- Clean-cut accounting and Premium and loss portfolio transfer

- Claims

- Risk XL, CAT XL and Stop Loss GNPI, Rate on GNPI, Rate on Line

- Earned and Written Premium

- Minimum Premium, Deposit Premium, MDP

- How to determine retention and Limits

- Event Limit in Risk XL

- Layering in Non-Proportional Treaties

- Risk cum Cat XL

- PML bust/PML error layer in Risk XL

- Two risk warranty and reverse two risk warranty

- Hour’s clause

- Number of reinstatements and reinstatement after a loss

- Experience and Exposure rating

- Burning Cost

- Swing Rating

- Pricing

- Understanding treaty profitability

- Exclusions - Important Clauses – Claims

- Introduction to Project Insurance.

- Erection All Risk (EAR) & Construction All Risk (CAR) Insurance- Coverage, Conditions, Exclusions.

- Underwriting of EAR & CAR Insurance.

- EAR & CAR Claims.

- Contractors Plant & Machinery (CPM) Insurance Coverage, Conditions and Exclusions.

- CPM – Underwriting & Claims.

- Introduction to Advanced Loss of Profits (ALOP) Insurance.

- Introduction to BI Insurance

- Gross Profit calculations using difference and addition methods.

- Material Damage Proviso.

- Indemnity Period and Policy period.

- ICOW and AICOW.

- Annual turnover and Standard turnover.

- Rate of Gross Profit

- Trends Clause application.

- BI Claim Calculations & Condition of Average

- Turnover Basis and Output Basis

- Dual Wages Basis

- Alternative basis clause

- Underwriting BI Proposals

- Premium adjustment calculations

- Contingent Business Interruption – Suppliers extension, Customers extension, Denial of access, Prevention of access, Wide area damages and Loss of attraction

- Covid 19 & BI Insurance.

About the Trainer

Atmaram Cheruvu

Co-Founder & Director – Mad Over Insurance

Electrical Engineer, Law graduate and MBA in finance, Atma has over 32 years experience in Risk Management, Insurance and Reinsurance. He was Head (Property & Casualty) and Chief Underwriting Officer of Hannover Re branch in India. He was Member of the Branch steering Board. Earlier to Hannover Re, He held senior positions in Sompo Japan and Royal Sundaram. He has been trained extensively on Risk Management, Insurance & Reinsurance in Europe, North America and Asia. He is a passionate training facilitator on various areas of Risk Management, Reinsurance and Insurance. He has conducted many programs internationally and is well recognised for simplifying the complex subjects. He has presented many papers at various National / International Seminars.

About the Trainer

Atmaram Cheruvu

Co-Founder & Director – Mad Over Insurance

Electrical Engineer, Law graduate and MBA in finance, Atma has over 32 years experience in Risk Management, Insurance and Reinsurance. He was Head (Property & Casualty) and Chief Underwriting Officer of Hannover Re branch in India. He was Member of the Branch steering Board. Earlier to Hannover Re, He held senior positions in Sompo Japan and Royal Sundaram. He has been trained extensively on Risk Management, Insurance & Reinsurance in Europe, North America and Asia. He is a passionate training facilitator on various areas of Risk Management, Reinsurance and Insurance. He has conducted many programs internationally and is well recognised for simplifying the complex subjects. He has presented many papers at various National / International Seminars.